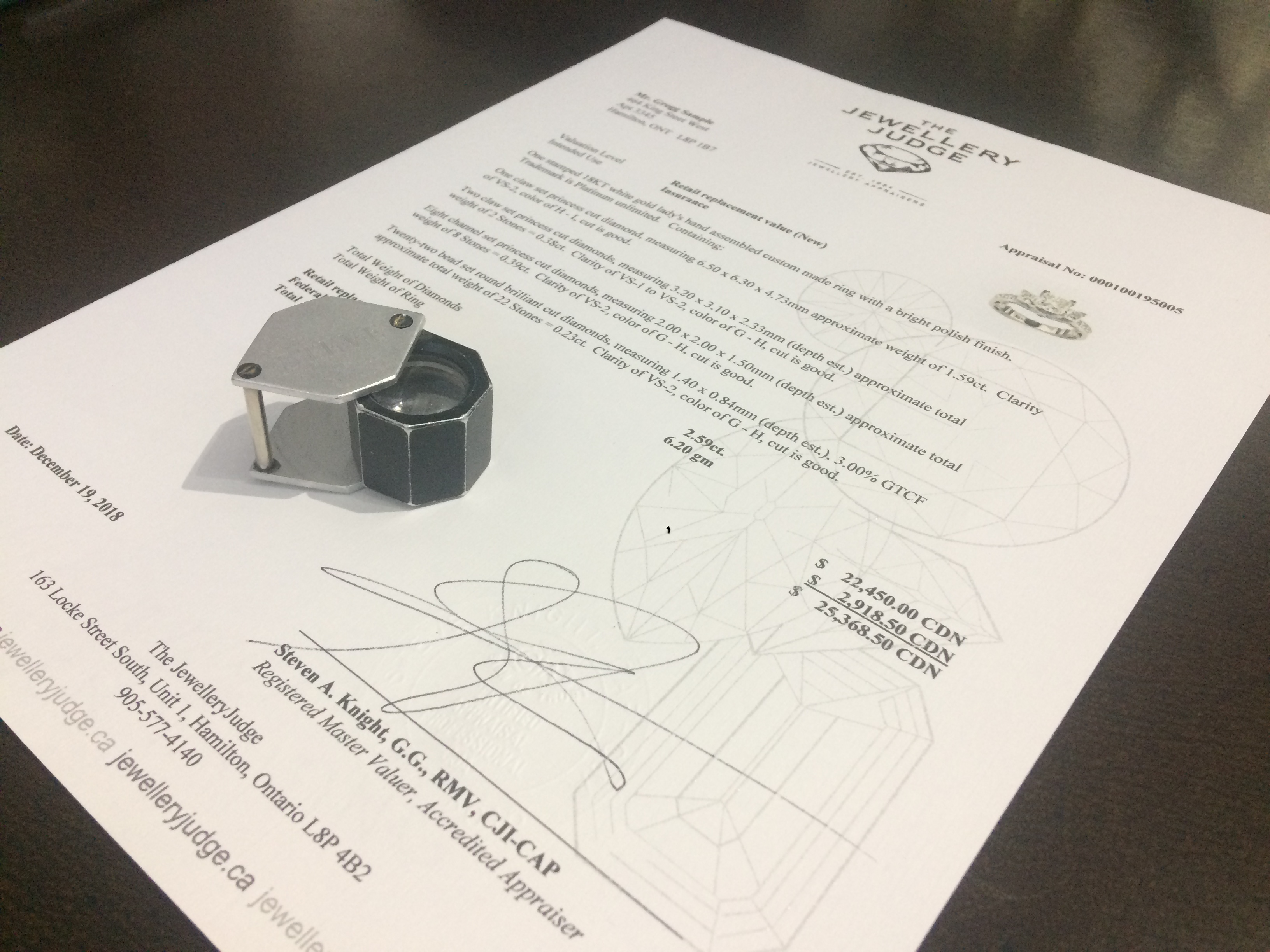

A Jewelry appraisal is a document that is made by appraisers that stats their estimation of the value of a

piece of jewelry. In order to get an appraisal, you need to find a jeweler that has enough experience

who can perform an inspection of your piece of jewelry in-person. After this process of appraisal, you

will get a certificate that contains a short description of the item and its value. Also, it will have personal

information about the owner like name, address, contact, and date of the appraisal. The whole point of

an appraisal is to prove that you are the owner of the jewelry.

Why Do You Need an Appraisal?

The appraisal consists of the information about the selected piece of jewelry that will be presented to

your insurance company. If your jewelry is damaged or stolen, the insurance company can finance the

replacement or repair of your item. Naturally, minus your deductible. It is pretty usual for people to say

that some of their jewelry items are priceless. This is the reason insurance companies require the owner

to receive a third-party certification that will provide them with information about the value and other

descriptions.

Here’s the catch, a vast majority of insurance companies are covering the jewelry item to a certain

amount. For example, a certain insurance company will cover the insurance for your piece of jewelry in

case the item is stolen. In other cases of peril, like fire, vandalism, etc. you need to be sure what is

covered in your insurance policy. If you have an item that has a strong sentimental value for you, you

should consider throwing in extra coverage in order to make your insurance policy wider than it is.

Extra cover, or how it is sometimes called, scheduled personal property, is a method of you adding some

extra protection for your item by paying extra money. We are going to give you an example of how this

works in reality. Firstly, you need to get the appraisal from your jeweler in order to verify the costs of

your item. Then you should tell your insurance company that you want to pay extra money in order to

get another layer of protection. This means that you can be insured in more cases than is written is your

average jewelry appraisal.

What Happens if You Don’t Get the Appraisal?

If you don’t want extra coverage for your item, you are only covered for the maximum amount that is

going to be covered by a classic insurance policy. Naturally, as we already said, minus your deductibles.

This means that you will be able to make a claim for some items that are costing more than the

deductible. However, you will still need to have a proof-like a bank statement or a receipt. There is a

chance that you might not get a full value of the worth of your jewelry.

When Do You Need to Get the Appraisal?

In case you have an item that is bought less than five years ago, and you have a receipt, then you don’t

need an appraisal at all. This is even better, you just need to show a receipt to your insurance company.

Naturally, in case you don’t have a receipt, you definitely need to get an appraisal in order to confirm

the value of the item. Also, if you want, for example, to add extra coverage on the item that already has

a jewelry appraisal, you only need to get an updated one.

Where to Find a Jewelry Appraisal?

In order for you to get a proper jewelry appraisal, the jeweler needs to be verified in-person and

inspected. So, the logic is that you should find a local jeweler that you maybe even know personally.

Furthermore, you should talk to your family and friends who can recommend a proper jeweler in your

city or neighborhood. If you are the type of person that likes to look for your jewelry appraiser online,

you should pay attention to the relevant experience and training. You should look for several formal

trainings like:

– American Society of Appraisers

– National Association of Jewelry Appraisers

– International Society of Appraisers

Vermont Republic Second Vermont Republic

Vermont Republic Second Vermont Republic